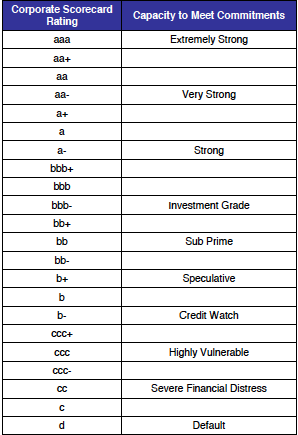

Rating Definitions

Credit ratings provide an Agency's opinion as to the capacity, viability and willingness of an entity to meet their respective financial and contractual commitments. As such credit ratings are assigned in accordance with the entity, commitment or product's proximity to default.

An Investment Grade classification is attributed to those credits that exhibit a lower probability of default, and are assigned a rating of bbb- and above. A Sub-Prime classification is assigned to those credits with a higher risk profile, being rated bb+ and below, and having a greater expectancy of default. Corporate Scorecard assigns ratings based on the credit worthiness of an entity or a specific financial commitment, and provides probabilistic assessments of default over the short, medium and long-term.

Corporate Scorecard's credit ratings adhere to internationally recognised grades and are similar to other agency classifications, providing ratings across twenty-one credit notches from ‘c’ (highly vulnerable) to ‘aaa’ (extremely strong). Each credit has some probability of default over a period of time, even those assigned with the strongest of ratings.

The credit rating (and probabilities of default) assigned to an entity, commitment or product, does not indicate an absolute potential of failure. It merely indicates that the credit is exhibiting all the characteristics of those which have defaulted at this level in the past. Future actions or inaction of management can move it towards or away from potential default.

A Corporate Scorecard credit rating may be assigned additional clarification markers (symbols) to qualify the credit risk assessment. Learn more about credit rating symbols.

Login

Login